What 1099 Forms Do I Need For 2024

What 1099 Forms Do I Need For 2024. 1099 forms can be a little overwhelming, but they are. $310 per 1099, if you file after aug.

Payers must file paper 1099 forms with the irs. Key dates for filing 1099s in 2024.

In 2024 (For Tax Year 2023), Any Organization Filing Ten Or More Of Any Combination Of Varieties Of Form 1099 Must File These Forms Electronically.

See how various types of irs form 1099 work.

Payers Must File Paper 1099 Forms With The Irs.

$120 per 1099, if you file more than 30 days after the due date but by aug.

Copy A And B Should Be Furnished To The.

Images References :

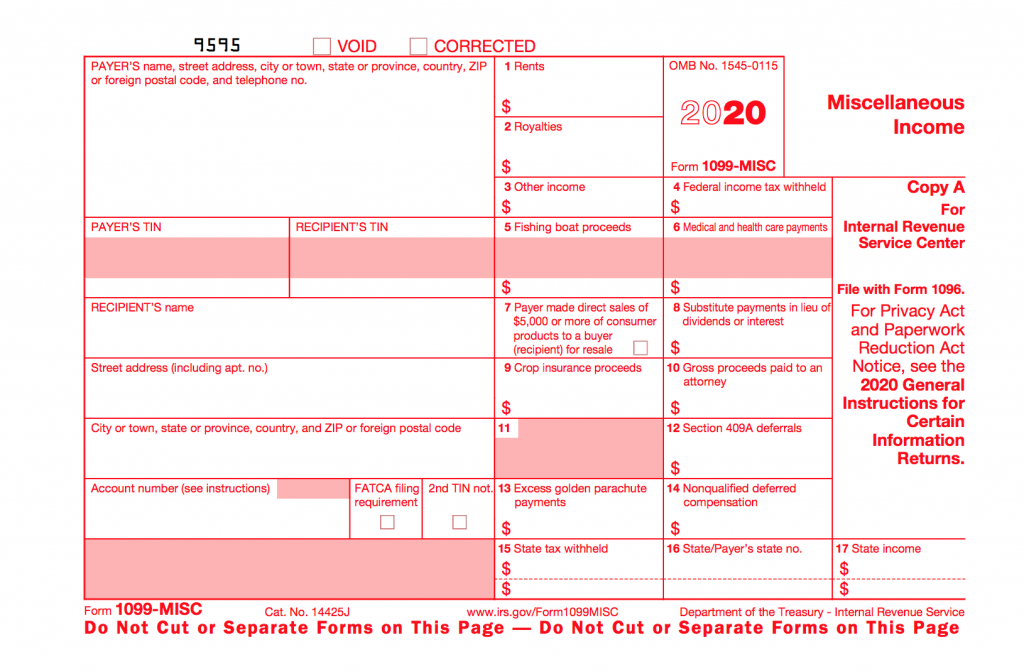

Tax Form 1099MISC Instructions How to Fill It Out Tipalti, Maximum penalty of $630,500 for small businesses; A 1099 form is a tax record that an entity or person — not your employer — gave or paid you money.

Source: ettyqhollyanne.pages.dev

Source: ettyqhollyanne.pages.dev

1099 Tax Deductions List 2024 Nerty Melisa, $120 per 1099, if you file more than 30 days after the due date but by aug. Maximum penalty of $630,500 for small businesses;

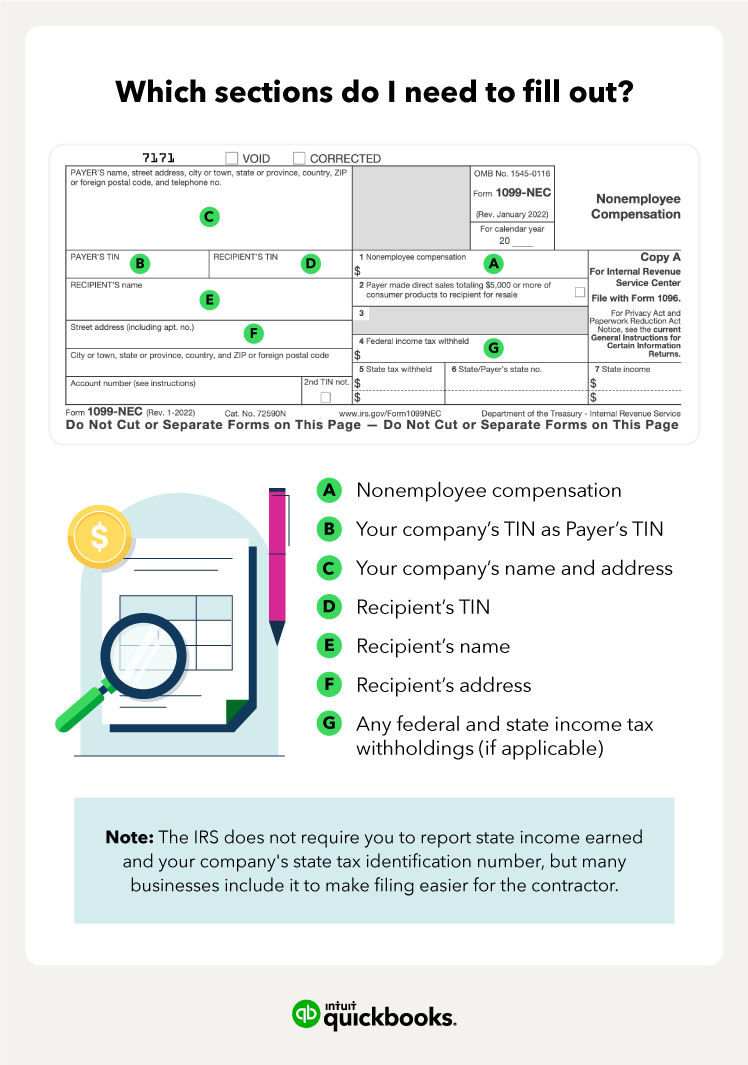

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

How to fill out a 1099 form QuickBooks, When are 1099s due in 2024: Your tax form is on time if it is properly addressed and mailed on or before the due date.

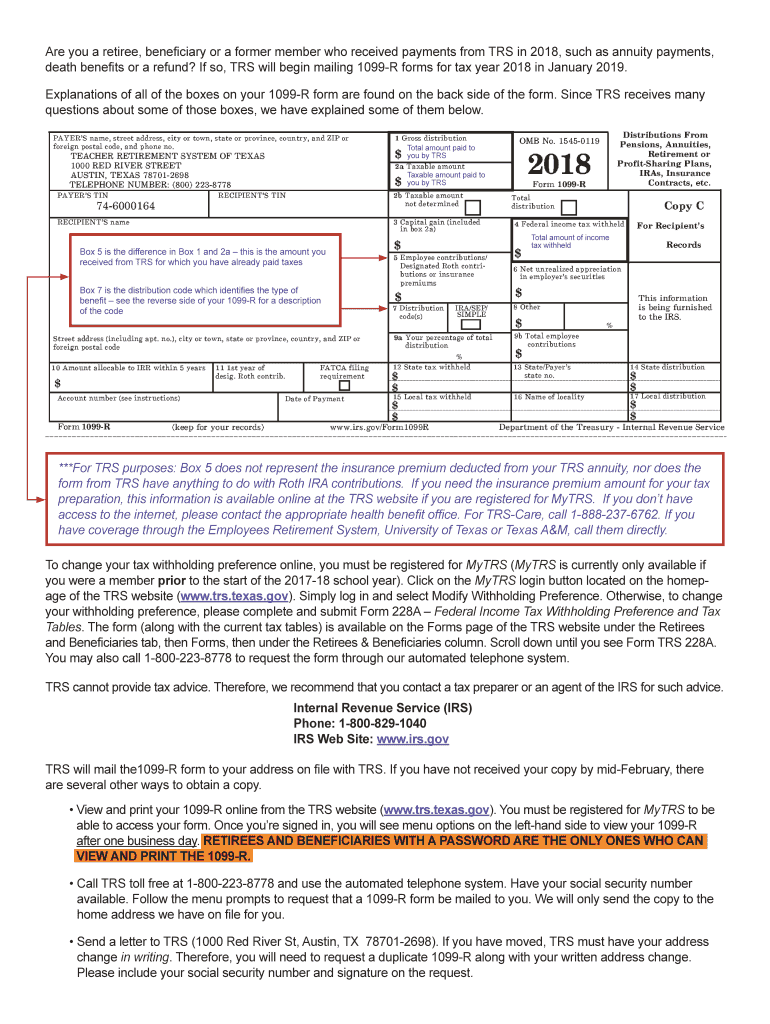

Source: www.schwabmoneywise.com

Source: www.schwabmoneywise.com

Schwab MoneyWise Understanding Form 1099, But for now, it’s still $20,000. $120 per 1099, if you file more than 30 days after the due date but by aug.

Source: www.waveapps.com

Source: www.waveapps.com

What are IRS 1099 forms?, The irs has plans to decrease the minimum reporting threshold to $5,000 for the 2024 tax year. This story is part of taxes 2024, cnet's coverage of the best tax software, tax tips and everything else you need to file your return and track your refund.

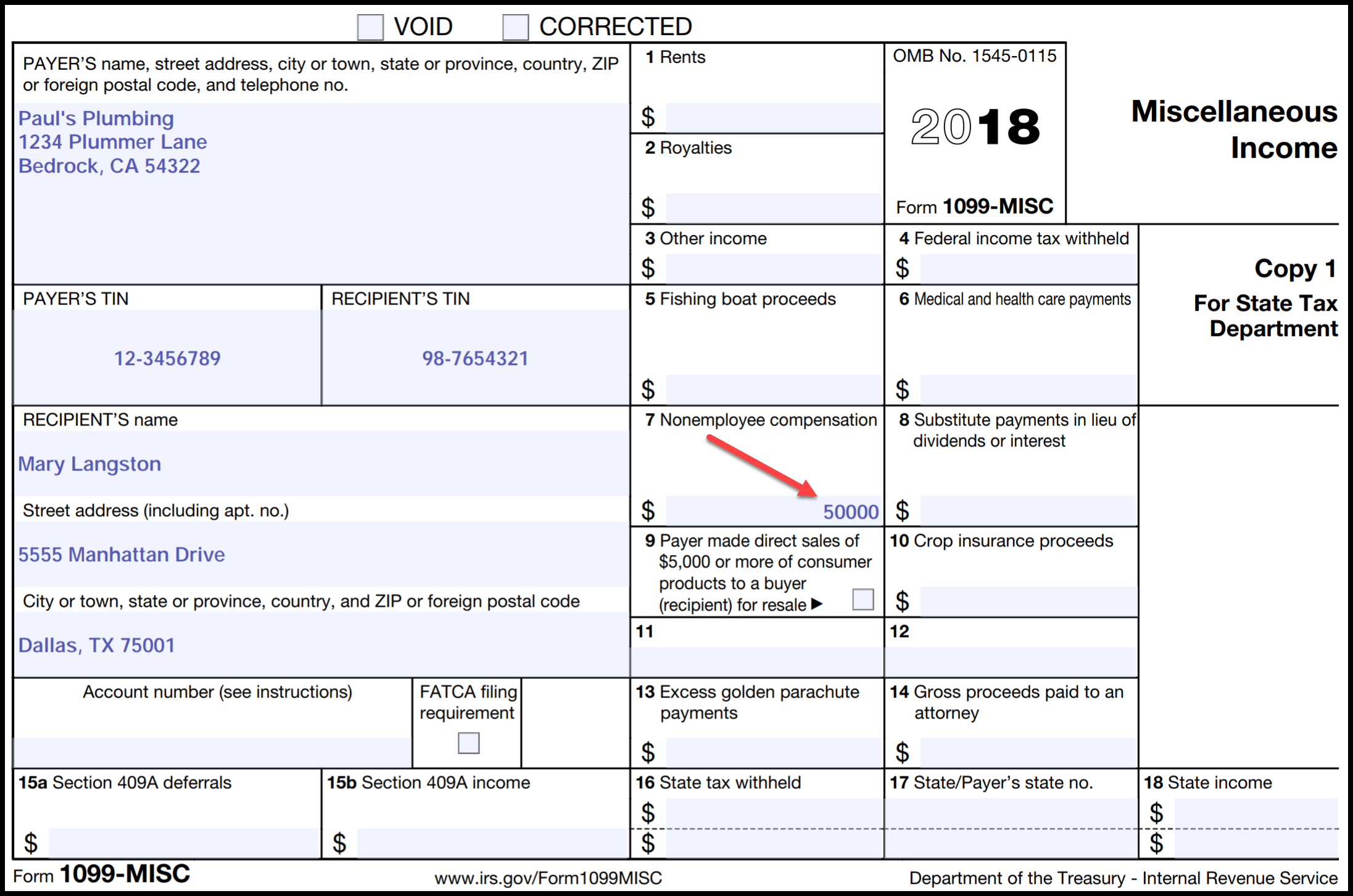

Source: www.bench.co

Source: www.bench.co

What Is a 1099 Form, and How Do I Fill It Out?, The irs has plans to decrease the minimum reporting threshold to $5,000 for the 2024 tax year. See how various types of irs form 1099 work.

Source: arielqshaylynn.pages.dev

Source: arielqshaylynn.pages.dev

1099 Form For Contractors 2024 Linda Paulita, When are 1099 forms due? $310 per 1099, if you file after aug.

Source: singletrackbookkeeping.com

Source: singletrackbookkeeping.com

What Are 1099s and Do I Need to File Them? Singletrack Accounting, In 2024 (for tax year 2023), any organization filing ten or more of any combination of varieties of form 1099 must file these forms electronically. Copy a and b should be furnished to the.

Source: www.dochub.com

Source: www.dochub.com

Texas 1099 form Fill out & sign online DocHub, $310 per 1099, if you file after aug. Learn about the irs 1099 form:

Source: freeprintablejadi.com

Source: freeprintablejadi.com

Irs Form 1099 Reporting For Small Business Owners Free Printable 1099, $310 per 1099, if you file after aug. Your tax form is on time if it is properly addressed and mailed on or before the due date.

$120 Per 1099, If You File More Than 30 Days After The Due Date But By Aug.

Maximum penalty of $630,500 for small businesses;

The Irs Has Plans To Decrease The Minimum Reporting Threshold To $5,000 For The 2024 Tax Year.

The deadline for filing 1099 forms depends on the type of form you are filing.